Opinion

Labor franking credit furphies hurt the most vulnerableCould there be a clearer example of fake news: repeating that tax wasn’t paid when clearly it was?

Adrian Blundell-Wignall

May 8, 2019 — 11.00pm

Regardless of who wins the next election, the question of trust and ethics in our politicians will remain. Ethical issues are normally hard to dissect, when generalisations and vagueness abound. But the Labor Party assertion that people who get franking credit refunds haven’t paid any tax, so the taxpayers are giving them a gift, raises an ethical issue. These people have paid tax – they are the beneficial owners of companies and had a 30 per cent tax paid for them by the “legal person” charged to do so on their behalf.

Confiscating their refunds undermines property rights.

The latest Edelman Trust Barometer shows that Australians do not trust their governments. Just 45 per cent of men and only 39 per cent of women trust government in Australia. Employers (77 per cent) and general business (52 per cent) are trusted more than government – imagine, governments trusted less than the finance sector, which underwent the royal commission

“Trust’’ is about reliance. If I am to rely on my government, then I am trusting that they will act truthfully and in the collective interest and hence I, in turn, can base my actions on this understanding.

At a general level it’s likely that superannuation policy has broken trust by continual changes in the rules. You cannot rely on politicians not to keep dipping into the honey pot. Nevertheless, such policies are the prerogative of governments and they treat equals equally. The franking credit proposal is quite different to this.

Labor has thrown up a snowstorm of rationales:

Giving refunds is a gift due to a tax loophole.

No other country in the world refunds franking credits, so nor should we.

People with self-managed super funds (SMSFs) are wealthy and rorting the system.

The alleged franking ‘‘loophole’’

A tax ‘‘loophole’’ is an unintended aspect of the law that allows taxes to be avoided. A ‘‘refund’’ is the repayment of a sum of money (it belongs to you). No one is avoiding either company or income tax under the current system. The ‘‘legal person’’ paid the company tax on behalf of the ‘‘beneficial owner’’.

The basic cause of the refund is that the money paid – the property of the beneficial owner – can’t be used in the way the company intended because government policy allows super income to be drawn down tax free.

Background: A limited liability company is the ‘‘legal person’’ in corporate governance that has responsibilities vis-a-vis the shareholders (the beneficial owners). Its presence ensures shareholders aren’t liable beyond their invested capital (the ‘‘corporate veil’’). Tax loopholes can arise. The corporate veil may be used to disguise the beneficial owners for illicit tax purposes, such as chains of shell companies ending in the Cayman Islands. Such genuine loopholes are worthy of attention by our politicians.

The economic reason to take a 30 per cent tax on the company income – income that belongs to the beneficial owners – at the level of the legal person is to stop the latter from protecting shareholders with income-tax rates above 30 per cent by holding back cash inside the ‘‘corporate veil’’. The legal person then distributes dividends to the beneficial owners and ‘‘imputes’’ the amount of company tax that was paid on their behalf (the attached ‘‘franking credit’’).

At this point, those with income-tax rates above 30 per cent are asked to pay more. What the company paid for you counts towards your income tax, and you pay the difference. A tax-exempt person with income from the same company also had 30 per cent of their income paid in tax.

Logic check: But we made this person tax-free for super income. We must therefore refund the tax paid on their income from this source.

Could there be a clearer example of fake news: repeating that tax wasn’t paid when clearly it was? This proposal amounts to the opposite of a ‘‘loophole’’. It is an ‘‘artifice’’ to raise the tax rate on company-sourced income. Confiscating this money from retirees (but not from other shareholders), while shifting the focus for unaffected voters – ‘‘anyway we will give the money to schools’’ – is sugar-coating discrimination between equivalent beneficial owners. It undermines property rights.

The only country in the world paying refunds?

Aside from the ridiculous logic here – other kids don’t do their homework so nor should I – only five OECD countries have imputation schemes: Australia, New Zealand, Canada, Mexico and Chile. So, the rest of the world is just four countries. Of these, only one – New Zealand – has tax-exempt draw-downs from super (the others tax draw-downs, so all credits are usable).

So, the rest of the world reduces to one. But New Zealand never had compulsory super and never gave refunds, so people were able to plan to ensure tax credits were usable for those in their voluntary system. Australia did allow refunds and self-managed super funds became large. Older Australians can’t now go back decades and re-plan their future. We will be the only country that has entrapped a new tax base and then changed the property rights to confiscate from them.

Rich people rorting the system

The Labor leader’s website says: “some funds are paying zero tax and collecting a $2.5 million cheque from the tax office”.

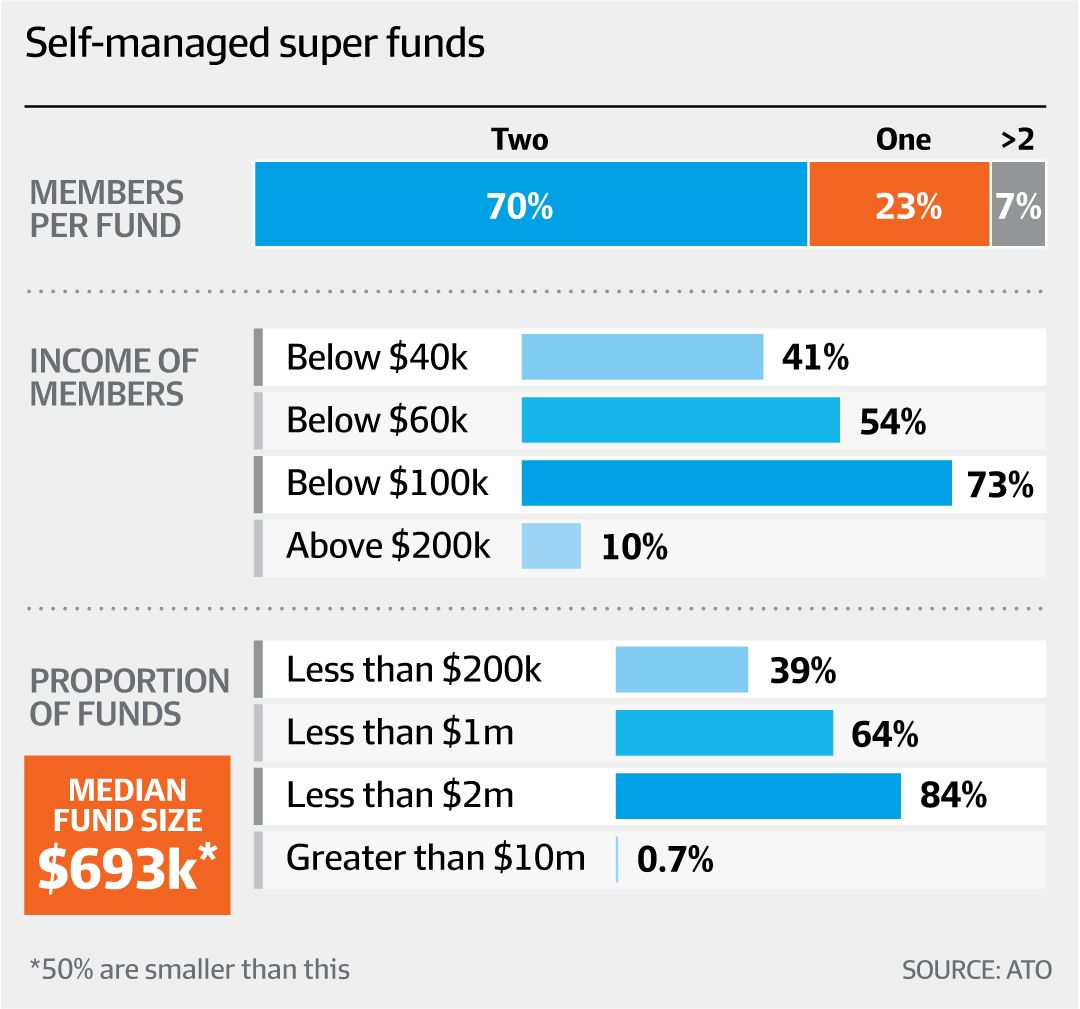

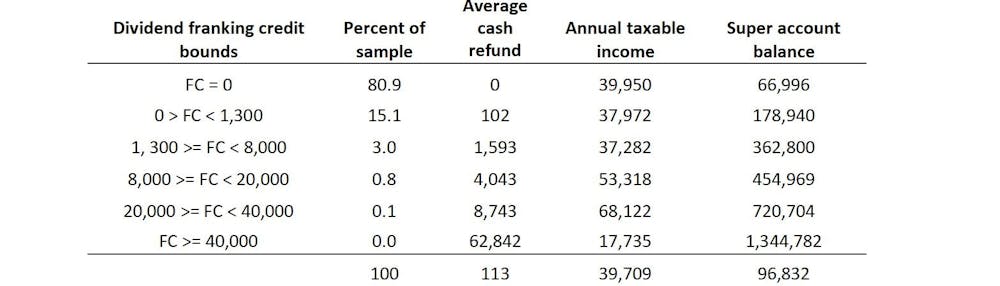

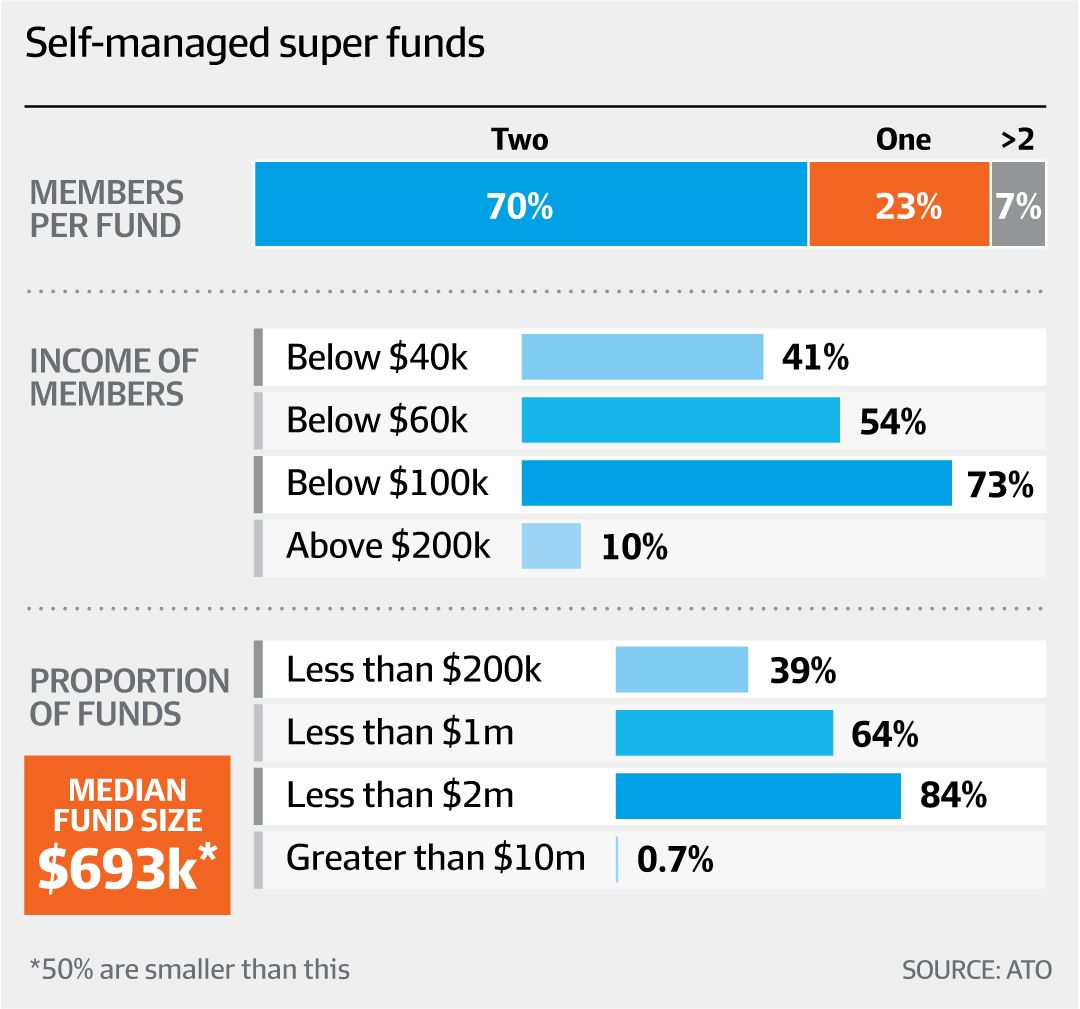

This old debating tactic of appealing to extremes works by shifting the premises to debating the truthfulness of the extreme rather than its representativeness. Let’s look at the ATO data on SMSFs instead (see the table).

The majority of SMSFs are not so rich after all. The ALP leader’s example can only come from a fund greater than $10 million. But such funds are only 0.7 per cent of the total. Slippery stuff.

A reality and an irony

The reality is that a couple with the median fund could take the median income and just make it to the end of their 80s. Labor’s policy will reduce their income by 15-25 per cent and they will make it only to their mid-80s. The irony is that wealthier people with advisers will avoid all this. There are many options: switch money into a pooled fund; add accumulation members to your SMSF; sell shares with capital gains and offset the capital gains tax with the imputation credits; and switch to non-equity products.

Labor’s policy will hurt the most vulnerable. Undermining property rights and confiscation is intolerable.

Adrian Blundell-Wignall is a former director of the OECD, an adjunct professor at Sydney University, and author of Globalisation and Finance at the Crossroads.